Have you thought about the legacy you will leave? Sometimes, we think deeply about life’s short nature. These moments remind us to secure our financial legacy for our loved ones. Life insurance and estate planning help ensure your family’s peace of mind. They feel protected, knowing they’ll be taken care of without you.

Integrating life insurance and estate planning into your finances protects your assets. It makes inheriting smoother for future generations. Planning helps with estate taxes, funding trusts, or keeping a family business stable. Planning ahead shows your love and care, lasting well beyond your lifetime.

Table of Contents

ToggleKey Takeaways

- Life insurance is vital for estate planning, protecting assets and ensuring their passage to loved ones.

- Whole life insurance policies aid in business succession and cover estate taxes.

- When picking a life insurance policy, consider your income, healthcare costs, and family size.

- Updating your beneficiaries regularly is key to reflecting life changes.

- An irrevocable life insurance trust (ILIT) can shield insurance from estate taxes and creditors.

The Importance of Life Insurance in Estate Planning

Making life insurance a part of your estate plan is crucial. It ensures your loved ones are financially secure. The money from a life insurance policy can pay for funeral costs, debts, and estate taxes. Otherwise, your heirs might need to sell things when prices are low, losing estate value.

Life insurance acts as a safety net for your family. It gives them tax-free money to help keep their life stable. It’s vital for keeping your family’s way of living, especially since life insurance death benefits could be part of the estate without right planning.

Here’s why life insurance is key for taking care of your loved ones:

- Equalizing Inheritances: It makes sure all heirs get a fair share, without selling family treasures.

- Covering Estate Taxes: Its tax-free money can pay off estate taxes, easing your heirs’ load.

- Providing for Special Needs: It supports a trust for dependents with disabilities, guaranteeing their care and stability.

- Protecting Business Interests: Life insurance in buy-sell agreements ensures partners are treated fairly if one passes away.

An irrevocable life insurance trust (ILIT) enhances life insurance’s value in estate planning. It prevents the policy’s worth from being taxed, protecting the death benefit from estate taxes. Moreover, term life policies cover you for a time, but permanent ones last a lifetime. They help keep your legacy intact.

Choosing the Right Life Insurance Policy

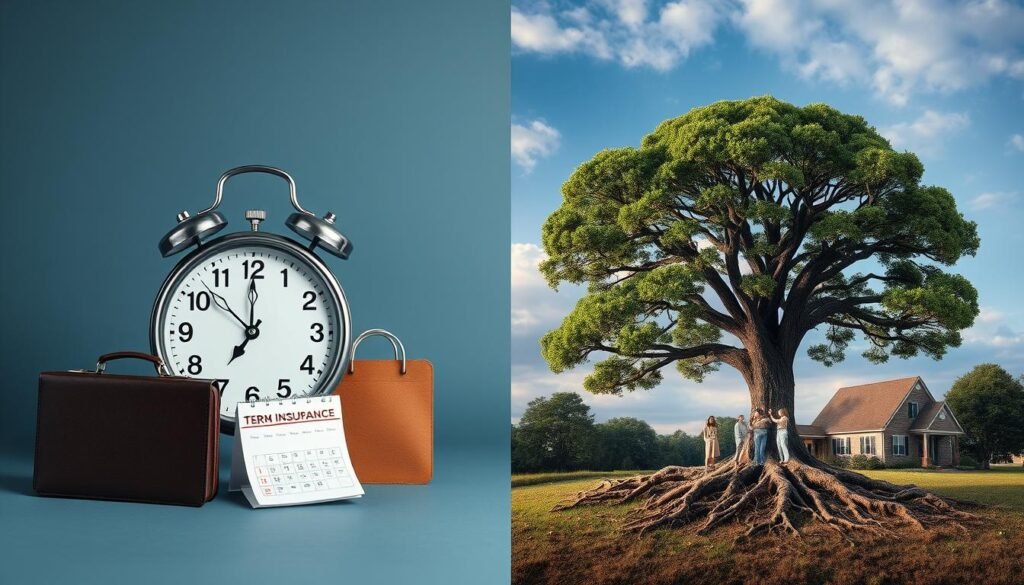

Understanding the types of life insurance is key. You can choose from term life insurance and permanent life insurance. Each type has unique features to fit your coverage needs and estate planning goals.

Term life insurance offers coverage for a set time without a cash value. It’s usually cheaper, making it a good choice for the young and healthy. It can be converted to permanent insurance easily. Yet, most term policies do not pay out a death benefit.

Permanent life insurance, on the other hand, covers you for life and builds cash value. With stable premiums and a growing cash value, it’s a reliable option. Some newer plans even let you share investment risks for potentially higher returns.

Permanent policies let you take out cash tax-free. Want flexible premiums? Look into a universal life policy. GUL policies are like term insurance but with lower costs and little cash value. Indexed universal life policies earn interest based on market indices.

To choose the best life insurance, think about your finances, risk tolerance, and your dependents’ future needs. The right coverage ensures you meet your goals effectively.

| Type | Coverage Duration | Cash Value | Investment Element | Premiums |

|---|---|---|---|---|

| Term Life Insurance | Specific Period | None | No | Low |

| Permanent Life Insurance (Whole Life) | Lifelong | Yes | No | High |

| Permanent Life Insurance (Universal Life) | Lifelong | Yes | Variable | Variable |

| Guaranteed Universal Life (GUL) | Lifelong | Minimal | Yes (Variable) | Low |

Strategies for Using Life Insurance in Estate Planning

Estate tax planning can be effective by using life insurance. It helps cover costs and lessen estate taxes. By funding trusts, like irrevocable life insurance trusts (ILITs), you reduce estate taxes. This means beneficiaries get more benefits from your policy.

Life insurance payouts are usually not taxed. This makes them a solid choice to pay off estate duties. Duties like funeral expenses, business debt, or estate taxes need to be paid in cash within nine months of dying. Life insurance stops the need to quickly sell valuable assets, which avoids extra taxes.

| Strategy | Benefit | Implementation |

|---|---|---|

| Irrevocable Life Insurance Trust (ILIT) | Protects proceeds from estate taxes and creditors | Transfer policy ownership to the ILIT |

| Survivorship Life Insurance | Provides financial support for special needs dependents | Pair with a Trust to ensure dedicated funds |

| Business Continuity Planning | Smooth transition of business ownership | Utilize buy-sell agreements with whole life policies |

Using life insurance to fund trusts helps split inheritance fairly among heirs. It avoids disputes. When estate taxes are due, life insurance offers an immediate source of money. It also gives your family quick access to cash, helping with expenses during probate.

These tactics ensure your assets are handed out correctly and lessen financial stress on your family. Work with estate planning lawyers for a plan that mixes life insurance and trusts. This optimizes how your estate is handed over and managed.

Maintaining and Reviewing Your Life Insurance Policies

It’s important to regularly check your life insurance to match your changing life and finances. Now, with estate taxes high and set to possibly drop by 2026, staying informed is key. For instance, Massachusetts’ estate taxes affect estates worth over $2 million, which could hit many people with taxes up to 16%.

Keeping your insurance up-to-date is crucial. It means checking your coverage and who you’ve named as beneficiaries. Have your wishes changed? By updating beneficiaries now and then, you can make sure the right people benefit, preventing family arguments.

How you arrange your life insurance can greatly aid your estate plans. Moving your policy to an irrevocable trust is a smart choice. It keeps the payout from being taxed when you’re gone, ensuring more goes to your heirs.

For business owners, life insurance plays a big role too. It’s often used in plans that determine what happens to your share of the business when you pass away. Regularly updating your policy helps maintain these plans, keeping business handovers smooth.

As retirement nears, the purpose of your life insurance might shift. It moves from replacing lost income to safeguarding your wealth and setting up legacies. Choosing the right type of policy becomes essential, as does adjusting premiums for better affordability. Changing to a permanent policy from a term one, or using cash values for extra income, are options worth considering.

Getting professional advice is always a good step. A Chartered Life Underwriter (CLU) can offer deep insights into keeping your insurance strategy solid. Life insurance payouts are usually free from income tax for your heirs, making it a strong component of family and financial planning.

Conclusion

Adding life insurance to your estate plan is key for protecting your legacy. It keeps your loved ones financially secure. You have options like term, whole, and universal life insurance. They fit different needs and goals. Life insurance can also pay for taxes and expenses quickly, without selling assets early.

Future planning is essential, and life insurance is a strong part of that. Choosing the right beneficiary lines up with your estate plans, helping your heirs. Also, life insurance proceeds usually skip probate, getting your family money fast. This is crucial as funeral costs can be a huge burden, ranging from $7,000 to $12,000.

Another smart move is setting up an Irrevocable Life Insurance Trust (ILIT). An ILIT gets the policy out of your taxable estate, which can lessen estate taxes. With the federal estate tax exemption ending in 2025, an ILIT is becoming a popular option.

Life insurance is not just a policy; it’s key to protecting your family’s future and estate. You can ensure your legacy and financial wishes last through life insurance. Consulting with financial advisors and estate planners adds to your plan. It gives you and your loved ones security and a well-structured financial path.

FAQ

What are the benefits of integrating life insurance into my estate plan?

Adding life insurance to your estate plan secures your family’s financial future. It gives them funds for daily costs and maintaining their lifestyle. It helps with funeral expenses, debts, and estate taxes, protecting what you leave behind for your heirs.

How do I determine the right amount of life insurance coverage for my estate planning goals?

Choosing the right life insurance means knowing the difference between term and permanent options. You’ll need to think about your financial duties and what your dependents will need later on.

How can life insurance help in minimizing estate and inheritance taxes?

Life insurance can be smart for estate plans to help manage your assets with trusts. It pays for estate and inheritance taxes so you don’t have to sell other assets. This can lower the taxes your estate faces.

What types of life insurance policies are available, and which one should I choose?

There are two main life insurance types: term and permanent. Term insurance works for certain time needs. Permanent insurance is forever and grows cash value. Your needs and goals will guide your choice.

How often should I review and update my life insurance policies?

Regular reviews of your life insurance are key to staying on track with life changes. Keeping your beneficiaries updated is important. Moving your policy to an irrevocable trust can keep the payout out of your taxable estate.

Can life insurance be used to fund trusts and charitable giving?

Yes, life insurance can support trusts and charity. It moves wealth and supports philanthropy without lessening what your heirs receive. This way, your giving wishes are met without extra strain on your estate.

What role does life insurance play in asset protection and wealth transfer?

Life insurance is crucial for keeping your assets safe. It provides cash to handle taxes and costs, protecting your estate’s worth. It ensures your heirs get their inheritance quickly, avoiding the need to sell other assets.

Should life insurance be part of my retirement planning?

Yes, including life insurance in retirement planning is wise. It protects your family financially and can grow cash value for retirement. This helps both your stability and legacy goals.